At Base Camp last month, Coinbase announced it was “beginning to explore” a network token, a complete reversal of its previously adamant stance of having no plans to issue a token.

No one can blame them for this U-turn. For one, it’s perfectly understandable for a commercial entity to change its plans. Secondly, even if they had this plan back when the Base chain was launched in 2023, it’s conceivable they kept it under wraps. This would have been to avoid attracting hordes of airdrop hunters who are not their target users and participate disingenuously just to farm tokens. Missing out on an airdrop is a small matter, but having skewed data and failing to build an initial user base is a major one.

As soon as the news broke—even though it was just “exploring,” or even just “beginning to”—numerous airdrop farming tutorials sprang up. Even someone as slow to react as me decided to join in on the speculation… But to be honest, the real reason is that LikeCoin v3 was minted on the Base chain on September 1st, targeting to let Likers upgrade their v2 tokens by the end of this month. Therefore, I’m planning to write a series on the Base chain to help everyone get warmed up.

As for airdrops, having a reason to motivate yourself to try new chains and dApps is not a bad thing. However, the scale of the Base chain is already immense; getting in now is hardly “knowing it before it was big.” I would advise against having high expectations for a windfall. Instead, it’s better to focus on improving yourself. Even if you don’t get an airdrop, the knowledge you gain is a win. If you’re lucky enough to receive one, just think of it as an extra bonus.

Let’s start with some relevant background and fundamental knowledge.

From COIN to Base

Even if you’ve never bought crypto, most people have heard of Coinbase. They know it’s a centralized exchange, and some may even be its shareholders, as it is listed on the Nasdaq under the ticker COIN and was added to the S&P 500 index in May of this year.

Cleverly, Coinbase’s other major business segment is none other than Base. You could say that Coinbase = COIN + Base. The former is a part of the traditional financial system, compliant and by-the-book, widely recognized as one of the most regulated centralized exchanges globally (though it still couldn’t avoid being sued by the SEC led by Gary Gensler). The latter operates a decentralized web3 ecosystem by developing a Layer 2 (L2) network for Ethereum.

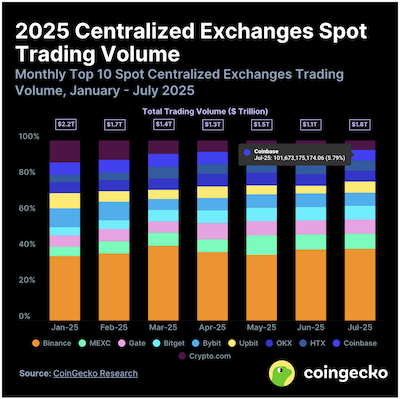

Some might argue that Binance is the world’s number one. By trading volume, it holds a market share of nearly 40%, while the well-known Coinbase has less than 6%. On the other hand, PancakeSwap, which runs on the BNB Chain, is the largest decentralized exchange (DEX) by trading volume, accounting for over 20%. Last month, rumors that the U.S. Department of Justice was about to settle with Binance sent BNB soaring past a thousand dollars to a new all-time high. It currently ranks fifth in market capitalization, trailing only BTC, ETH, USDT, and XRP.

To the victor go the spoils. Measured by numbers, Binance is indeed the undisputed “number one exchange in the world.” However, I admire Coinbase more. I respect its ability to be highly compliant within the traditional system on one hand—reassuring governments, corporations, and users unwilling or unable to self-custody their assets—while on the other hand, being able to respect web3 values, implement decentralized mechanisms, and foster a vibrant community when running its own chain. It’s deeply admirable.

Like many people from that era, I primarily used Coinbase when I first started buying crypto in 2017, although my very first transaction was on Kraken. Due to its positioning and regulations, Coinbase’s features were very bare-bones, but it was enough for me at the time. Fast forward a few years—I forget the exact time—perhaps to comply with U.S. regulations or simply due to U.S.-China tensions, Coinbase proactively removed all its “Hong Kong, China” users. While I might have been able to re-register using a BNO passport, I had long stopped using Coinbase and barely use any centralized exchanges anymore. I let them do as they pleased and didn’t look into it further.

You can’t please everyone. By highly cooperating with regulations and national policies, Coinbase not only had fewer token listings and simpler functions but also had to kick out long-time users. Permissionless blockchains thus became the perfect supplement; what COIN couldn’t serve, Base was there to satisfy. For me, however, it’s not that I use Base as a second choice because I can’t use COIN. Rather, the Base chain, with its various dApps, is inherently far richer and more user-friendly than COIN ever was.

L2 = Mahjong Chips

Although the grand premise of web3 is decentralization, most people either don’t understand or don’t care if the blockchain they are using is decentralized.

What’s more paradoxical is that the pursuit of decentralization often comes at the cost of user experience—either transaction fees are high, speeds are slow, or it’s just more troublesome. Conversely, public chains like BNB, which are not hung up on decentralization and instead “focus on user experience,” have been able to capture a massive user base at lightning speed.

In truth, if Coinbase had followed suit and replicated BNB’s success by finding some friendly validators, it could have easily created a fast, cheap (or even free for some transactions) Base chain. As long as it was compatible with the Ethereum Virtual Machine (EVM), plenty of dApps would have followed. Add some economic incentives for promotion, and users wouldn’t care about decentralization, especially with the Coinbase brand attached. But good on Coinbase for not taking the shortcut. It chose the Ethereum L2 solution, using Optimistic Rollups to let Ethereum secure the Base chain.

This bit of technical jargon can be roughly understood like this: Alice, Bob, Carol, and Dave are playing mahjong. Every time someone wins, they have to pay via a bank transfer. Even with mobile apps, this is quite a hassle. So, the four of them use chips to transact. They only settle the score and make a single bank transfer after the game is over. This is not only much more efficient but also drastically reduces the number of transactions the bank has to process. In this example, the Ethereum mainnet is like the old way of doing bank transfers—slower, even with mobile apps. The chips are the much more efficient L2. The act of settling up and finalizing the transfers with the bank after the game is the “rollup.”

As for “Optimistic,” it means, as the name suggests, that transactions on the L2 are optimistically assumed to be true and correct without any tampering. But this optimistic assumption doesn’t mean blind faith. The system has a seven-day “challenge period,” during which technical experts and the community can challenge any problematic transactions, preventing them from being finalized on the mainnet too quickly before they become irreversible.

To BASE or not to BASE

Since L2s use ETH to pay for transaction fees, chains that choose to be independent, like BNB, do so mainly to keep the profits in-house, unconcerned with having a truly decentralized mechanism to protect users’ assets. In contrast, by choosing to be an L2, the Base chain gains the security of Ethereum at the cost of giving up the opportunity to use transaction fees to drive the price of its own native token.

However, even if they can’t be used for transaction fees, most L2s like Arbitrum, Optimism, Scroll, etc., issue their own tokens for community governance and ecosystem incentives. These tokens are valuable and actively traded. In any case, apart from a very few exceptions like ETH and SOL, a token’s price usually has very little to do with transaction fee revenue.

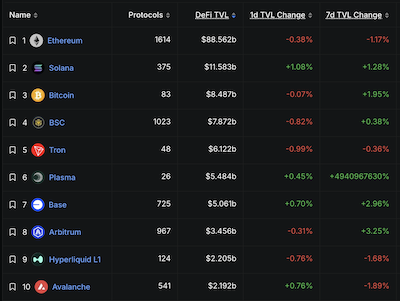

In fact, there are very few L2s that have reached a significant scale without yet issuing a token. What’s more, the Base chain is a top performer by multiple metrics. Its Total Value Locked (TVL) in DeFi has reached USD 5 billion, surpassing Arbitrum to become the largest L2. Referencing other chains of a similar scale, if Base were to issue a token, its market capitalization would be at least $10 billion, and could potentially hit $100 billion in a bull market—surpassing COIN’s current market cap of $80 billion! Even someone as slow as me realizes that Coinbase must have done the math. No one in their right mind believes they won’t issue a BASE token; the only questions are when and how.

Faced with the powerful momentum of the Base chain and the “beginning to explore” BASE token, should investors “ape in” to COIN? I’ll leave that for you to decide. As a user, by simply entering the Base ecosystem and trying out mainstream dApps and related tools, you can acquire new knowledge and potentially receive an airdrop. It’s a no-lose situation.

As for how to get started and what’s worth trying, I’ll be back next week to continue.

p.s. Before I knew it, three-quarters of 2025 have passed, and the year is in countdown mode. My thinking has shifted from ambitiously wondering “what new projects should I start?” and “how can I do more?” to a more conservative and resigned “how can I finish what I’ve already started?” and “what must I give up?” This is true for a year, and it is true for a lifetime.

Leave a Reply