Last issue, several friends left comments laughing that I was using clickbait titles. I half-jokingly replied, “You guys taught me that writing peacefully in the body text is useless.” Indeed, I’ve always been a “content person,” but the comment responses have never been so enthusiastic. If one day I truly become a clickbaiter, it would be a collective karma forced out by apathy.

If we can take one more step within our capabilities in our daily lives, although we won’t see immediate effects, accumulation will eventually bring about a turning point. Conversely, some people think it’s enough to suppress the surface appearances daily, not knowing that they are just accumulating resentment, which will have to be repaid someday.

Previously, I discussed the multiple meanings of the “D” in DHK. This time, from concept to practice, let’s talk about the “A” in DAO – how autonomous is to be implemented, starting with the DHK token distribution mechanism.

The DHK token is an ERC-20 smart contract built on Ethereum, with seven million tokens minted on the Layer 2 network OP Mainnet. Excluding one million reserved for backup, one hundred thousand tokens, worth approximately two thousand USD, are airdropped to the community monthly. In other words, six million DHK will be gradually distributed over 60 months, i.e., five years.

Guanyin’s Treasury Opening is Harder Than Imagined

Most people would assume that giving away money is simple, and any difficulty would merely be an overwhelmingly enthusiastic response. However, if the public hasn’t yet recognized the value of the token, or doesn’t understand what you’re talking about at all, giving away money is no easier than handing out flyers on the street. In 2010, Bitcoin developer Gavin Andresen created a “faucet” to give away Bitcoin. As long as you passed a simple reCAPTCHA to prove you were human, you could receive 5 BTC – more generous than Guanyin’s treasury lending. It seems incredible now, but its usage back then was very limited, showing just how difficult it is to give money to the public.

If this was the case for Bitcoin, it goes without saying for DHK. Although the plan is to airdrop one hundred thousand tokens monthly, only a portion of people ever claim them. Originally, if the goal was just to blindly chase KPIs “with results as the target,” even ten billion tokens could be easily distributed. But DHK dao chose the harder path, adhering to the principle of “proof of contribution/participation.” Tokens are distributed based on each user’s contribution to the community and require active claiming. Alternatively, after explaining to “Muggles” (newcomers), a trivial amount of 1 DHK, representing “daoyau” status, is issued, moving step-by-step towards the vision of bringing seven million people onto the blockchain.

Many things cannot be quantified, but to allocate resources, we have no choice but to measure the contribution of each daoyau. Taking April 2025 as an example, the monthly airdrop budget is split in half. Fifty thousand DHK are distributed to users who stake ATOM, OSMO, or AKT with DHK’s partner validator, allocated according to the square root of their income contribution:

- Calculate the income from the three nodes: ATOM, OSMO, and AKT. In April 2025, nearly 90% of the income came from ATOM.

- Based on the income proportion from ATOM, OSMO, and AKT, the fifty thousand DHK are divided among the three groups of users.

- The number of tokens a user stakes in each token’s validator node is taken square root, and this figure represents the user’s contribution, aiming to narrow the wealth gap.

- The DHK airdrop share for each user is calculated based on their contribution ratio.

As for the other fifty thousand, they are allocated to daoyau Pro who are paid subscribers to the weekly newsletter. This part of the calculation is much simpler. Continuing with April 2025 as an example, there were 182 daoyau Pro, so each received 50,000/182 = 274 DHK.

Interestingly, at the time of the airdrop in early May, DHK was 0.03 USDC, making 274 DHK worth about 8 USD, which is higher than the daoyau Pro monthly fee of 6 USD. And this wasn’t unique to April; the airdrop amount being higher than or close to the daoyau Pro monthly fee has been ongoing for a while. I don’t think any daoyau Pro subscribed just to earn money from airdrops, yet they inadvertently earned back their monthly fee or even more. This strange phenomenon is the “karma” of the blockchain industry, which I call “When will the cycle of reciprocal rewards ever end?“

The Art of Distributing “Leftovers” (下欄 – Haa Laan)

The above describes the distribution method, but whether users claim it is another matter. Of the 182 daoyau Pro in April, 101 provided wallet addresses to claim DHK, accounting for 55%, proving that daoyau Pro members pay to support, not to claim airdrops. “Saving” 45% of the airdrop budget isn’t a good thing; assets need to flow to be meaningful. Notifying and encouraging more people to participate has always been my work, including this article. But while trying hard to explain, I also understand very well that for many people, spending time to understand is a much greater commitment than paying money to support.

As for users staking ATOM, OSMO, and AKT, the base is much larger, totaling over twenty thousand people. However, due to the lack of user contact information, the claim rate for airdrops is much lower. For example, in the first quarter of 2025, seventy-five thousand DHK were allocated monthly to staking users, but the claim rate was only 8%. In view of this, the volunteers decided that starting from the second quarter, the airdrop quotas for staking users and daoyau Pro members would be adjusted to fifty thousand each, and the share for daoyau Pro members might be gradually increased further.

Speaking of contributions, how can we forget the volunteers? In Cantonese, there’s a term “下欄 (haa laan),” which originally referred to fruits in a fruit market that were about to rot and needed to be taken off the shelves. In the past, society wasn’t as affluent as it is now, but it valued thriftiness, so these fruits were distributed to employees. Over time, any practice of treating kitchen scraps, expired food, or any unsellable goods as employee benefits came to be collectively known as “haa laan.” A year ago, DHK dao borrowed this concept, distributing unclaimed airdrop tokens to volunteers each quarter based on their contributions, simultaneously solving the problems of “running on passion” (working for free) and asset stagnation – killing two birds with one stone.

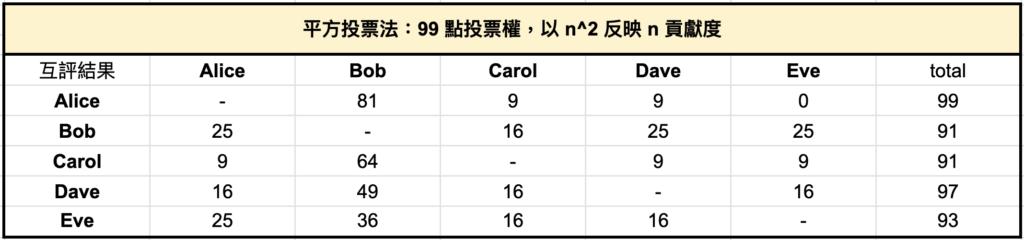

How to self-assess elegantly and fairly is another challenge in resource distribution. I remember during university, we often did group projects. Lecturers would require group members to conduct peer evaluations, where each person would allocate one hundred points among other group members based on their contribution. These points were then summed up to determine each person’s contribution score for grading purposes, preventing anyone from getting a free lunch. The method DHK dao volunteers use for peer evaluation is similar, but it employs quadratic voting (QV), requiring each person to use n² points to represent n contribution points, allocating a total of 99 points.

Here’s an example: Suppose there are five volunteers, and we first consider Alice’s scoring. Alice believes Bob contributed the most, followed by Carol and Dave, while Eve had no notable merits. So, she gives Bob 81 points, reflecting 9 contribution points (9² = 81); Carol and Dave each get 9 points, meaning 3 contribution points (3² = 9); 99 points have been used up, so Eve gets 0 points.

It’s relatively rare to use exactly 99 points. More often, because scoring is squared, it’s often impossible to sum up to exactly 99 points. Therefore, the principle for scoring is not to exceed 99 points, but it’s not necessary to use them all. This isn’t a design flaw but an intentional feature. The starting point is to prevent people from conveniently averaging out scores and to force evaluators to think more carefully.

Assume the scores from everyone are as follows:

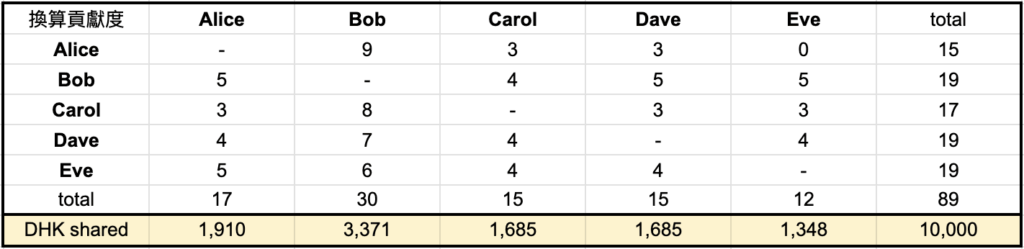

Finally, each person’s score is converted into contribution points and summed up. Then, the DHK is allocated proportionally. Assuming a total of 10,000 DHK, the allocation results are:

From the example above, it can be seen that although Bob’s contribution and score are outstanding, the distribution among everyone is not excessively disparate. Besides requiring participants to think more when scoring, quadratic voting can also effectively narrow the wealth gap.

Using quadratic voting, DHK dao’s volunteers have conducted three peer evaluations and “haa laan” distributions since the middle of last year. All related numbers, documents, and transaction records are fully open for inspection on the website dhk.org. No matter how long they are stored, data will not be deleted under the pretext of slowing down the website.

I often emphasize that if you want democracy, besides entering the system and taking to the streets to fight for it, you can also create it yourself. On this “specific day” of June 4th, no matter if the state machinery holds ten events in Victoria Park, even if I feel unwilling to accept it, I will absolutely not slow down my pace of creating democracy in daily life.

p.s. Apart from watching movies, I rarely set foot in shopping malls. This issue’s cover photo, a casual shot taken in a mall, is the first of its kind. I mainly feel that the giant panda “invading” Hong Kong, with Hong Kong people seemingly oblivious and living as usual, strongly reflects the reality of Hong Kong. (Mysterious voice: Otherwise, did you think the black-clad neighbor carrying two bags of groceries would physically block the giant panda?)

Leave a Reply