How many five-year periods does one have in a lifetime? I have had ten so far. I’ve spent one of them promoting cryptocurrency wallets, relentlessly trying every method imaginable to encourage others to open a wallet and take control of their own assets and data. It wouldn’t be an exaggeration to say I’ve tried everything under the sun.

This five-year period began on July 7, 2020, with the publication of The 5-Minute Sovereign Account, my first article for the #decentralizehk column in Hong Kong’s Apple Daily. A “sovereign account,” as I called it, refers to a “bank account” unfettered by any earthly regime—in other words, a cryptocurrency wallet. And “five minutes,” of course, meant that it could be set up with ease.

Argent Treats the Symptoms, Ethereum Tackles the Root Cause

Space in Apple Daily was precious. Each #decentralizehk piece was just over a thousand words, but rereading that first article, I’m struck by how much information it contained. It set the tone for the column, introduced the concept of a sovereign wallet, recommended a specific product, encouraged hands-on participation, extended into stablecoins, and even ended with a giveaway, sending 1 USDC to every user who replied. To the readers who received money from me, can I get a show of hands?

The wallet I recommended was Argent. It had just launched, offering fast and simple account creation without needing to write down a seed phrase or private key. Even better, all transactions were free, which allowed me to send crypto to a whole host of readers. Even today, five years later, these features are still on the cutting edge. Argent made this possible by using a smart contract as the account, allowing users to use their phone number, email address, and trusted friends as “guardians” to confirm transfers and other operations. As for the magic of free transactions, the secret was simple: Argent was footing the bill for users behind the scenes. But to call it simple isn’t entirely accurate; without using a smart contract as the account, it would have been technically impossible for the company to subsidize the transaction fees, even if they wanted to.

Unfortunately, Argent’s solution was only treating the symptoms. As the Ethereum network became congested, gas fees skyrocketed. The complexity of smart contract wallets further drove up fees, and the subsidy model quickly became unsustainable. My campaign to promote the Argent wallet and give away USDC ended after bringing a few hundred people into the fold. Luckily, while Argent may have lost its momentum, it was by no means a scam. After many twists and turns, the smart contract wallet is still alive and well. It recently rebranded to Ready, relaunching with the slogan “Argent is now Ready” and announcing an upcoming MasterCard.

As for Ethereum, its path has been to tackle the root cause. With a deliberate yet swift rhythm, it has undergone annual updates, gradually implementing major features like Proof-of-Stake (PoS), Layer 2 networks (L2), and account abstraction. These upgrades have transformed features like seedless smart contract accounts and user subsidies from theoretically possible to practically feasible.

Modern dApps: The Account is the Wallet

Fast forward to today, and the world has completely changed. Circle, the issuer of the USDC I was giving away, successfully went public a few months ago. Its stock price once surged by 800% and, despite a slight pullback, is still up over 600%. Stablecoins have become a hot topic, with YouTubers, professors, analysts, lawmakers, and even presidents all talking about them. However, the focus is often on their use as an extension of state power, a tool for digital colonialism, and a pawn in geopolitical power struggles. In comparison, the topic of how Web3 can create financial autonomy (what I call “financial freedom“) and protect civil rights is increasingly being marginalized (so please, support those who are still holding the line).

The voices of grand discourse may be fading, but that doesn’t mean the tools for achieving financial autonomy have stopped in their tracks. Quite the contrary, technological evolution is revolutionizing the most fundamental aspect—the wallet experience—at an unprecedented pace. Following significant improvements to Ethereum’s base layer, wallet software is gradually catching up. Coinbase Wallet, OKX Wallet, Ambire, Rabby, and even the veteran MetaMask are all continuing Argent’s unfinished mission in various forms. For new users entering the Web3 ecosystem, unless you’re the type of person who prefers a manual transmission and enjoys controlling every detail, there is no longer a need to write down and save a seed phrase just to hold crypto assets.

Wallet software is account-centric: you first create an account and then use it across different dApps. Embedded wallets, however, take the opposite approach. They are application-centric: when a user decides to use a dApp, a wallet is created at the same time they register for an account. Some of the more popular examples include Privy, which was mentioned in Blocktrend last month; Magic Link, which is currently suing Privy for infringement; and Web3Auth. With PayPal investing in Magic Link, Stripe recently acquiring Privy, and Consensys acquiring Web3Auth, it’s clear that the embedded wallet space is a fiercely contested battleground.

On the surface, an account that comes with a wallet might not seem like a big deal—this is how centralized exchanges have always operated. However, the wallets on centralized exchanges are custodied by the platform from start to finish; the assets are held by the exchange. With embedded wallets, unless the company is a scam, the vendor cannot access the user’s private keys. The user manages their own assets. The difference of a hair’s breadth leads to a world of difference.

With application-centric embedded wallets, even if a user registers an account with the same email address in every application, the generated wallet address will be different. You have as many wallet addresses as you have applications. In contrast, wallet-centric solutions allow a user to reuse the same wallet address across countless applications. On the surface, this characteristic of embedded wallets reduces the composability of dApps, making it seem like a bug or at least a shortcoming. In reality, it also helps to compartmentalize a user’s identity across different applications. Depending on the situation, this can also be a feature or an advantage. For instance, if you buy eggs, butter, and cake flour at the same store, the shopkeeper and onlookers can probably guess you’re making a cake. But if you use three different identities to make the purchases, your privacy is well-protected. If this example is still too abstract, here is a real one.

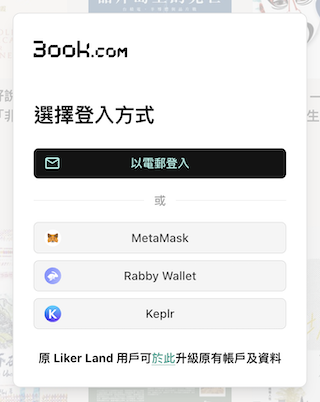

Last month, Liker Land launched an AI book companion, 3ook.com, which uses Magic Link as its login solution. While I see popularizing science as my mission, in the context of the product, I am a designer. It makes no sense to require users to learn the technology before they can read a book (especially since I, as an author, have been making this request for years). Most authors and readers are Muggles, so I enabled them to register or log in simply by providing an email address, not even password is needed. And with an account comes a wallet. The account is the wallet. There’s no longer a need to make a big fuss about pulling out a pen and paper to write down a seed phrase.

However, if a device has a wallet like MetaMask or Rabby installed, it’s reasonable to assume the user has some Web3 experience. In that case, other login options will appear below the email field, allowing them to log in with their preferred wallet. In my case, my long-standing wallet account is linked to my ckxpress.eth ENS, my creative works, donations, and other public transactions. I wanted to hold my books on 3ook.com under this public identity, so I chose to log in with my wallet.

The 5-Minute Sovereign Account + Giveaway 2.0

Five years have passed, and the population of people who self-manage their wallets and assets remains a minority. The path of popular science is a long one. Whether you missed the tutorials before or read them but were too busy to act, I want to take this opportunity to once again invite you to spend five minutes opening a sovereign account. No, two minutes is enough. Just open 3ook.com, click “Log In,” enter your email address, and then enter the verification code.

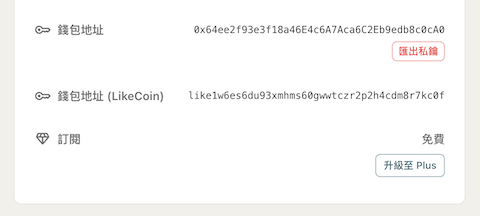

As for the giveaway, USDC has become utterly mainstream. A marginal figure like me is no longer qualified to help popularize it. Instead, I will be giving everyone the “legal tender” of our fellow crypto travelers: DHK. If you’re interested, simply copy your 0x wallet address from your account page on 3ook.com and fill out this one-question form before the next newsletter. I will send you DHK and a small amount of ETH next week.

Please seize this opportunity. If you miss it, you might have to wait another five years. No, I trust that in five years, all of this will be common knowledge, and I will no longer need to do such a foolish thing.

p.s. I don’t know whether to praise myself for being persistent and having perseverance, or to criticize myself for being a creature of habit and set in my ways. I effortlessly find cases in which I write articles that are still highly relevant to society five years later, work on projects that have been ongoing for a decade, and use tools I haven’t replaced in twenty years. By writing on these topics so often, I fear I’m increasingly becoming a pedantic, inflexible old-timer who’s always looking back at the past.

Leave a Reply